OTAs account for more than 30% of the 25 most popular travel apps with Airbnb and Booking.com leading the way

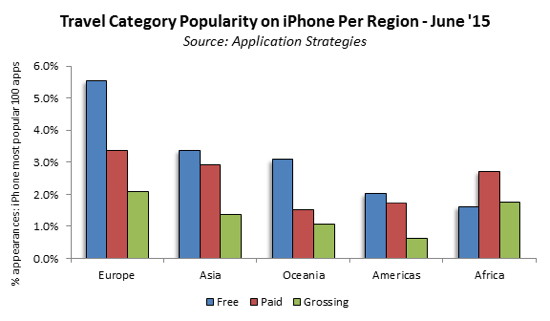

The data should help travel companies create more targeted global distribution strategies with appeal to local markets. One key facet, however, is nearly universal across the globe - travel apps are seen as a local-first apps. The most popular apps are navigation - Maps.ME appeared in 100% of countries each week in June. Other popular apps include Uber, Yelp and Foursquare – all appearing the most frequently across the 150 countries analyzed. For hotels and airlines competing to reach connected travelers the lack of momentum placed on their apps should be concerning as ever more resources are invested in developing applications.

In fact, of the 25 most popular apps 8 were OTAs (Airbnb, Booking.com, Hotels.com, Expedia, Kayak, trivago, Hotel Tonight and momondo), 2 were airline apps (Lufthansa, United) and 0 were hotel apps. The dominance of OTAs, combined with the lack of branded hotel and airline apps demonstrate how iPhone owners want to book travel experiences and are putting OTAs in a position of power on the mobile device. This will be exploited as more consumers in more countries begin using mobile devices for travel bookings.

According to Joshua Martin, Chief Researcher of the Application Strategy group, “While the travel category may be less popular in most emerging markets, companies should see this not as a challenge but as an opportunity. Applications and smartphones are the way that many of the next billion internet users will first come in contact with these well- known travel brands which present an opportunity for customer acquisition. Ensuring apps are regional and country specific, speak to various global audiences and provide a quality experience are essential during these first run branding exercises.”