The impact of the increase in the National Living Wage (NLW) on labour costs in 2024 is forecast to hit UK hotels, particularly in the regions. This will put the spotlight once again on the need for top line growth and smarter cost control to maintain or improve profitability.

The figures are revealed in our latest gross operating profit (GOP) forecast, using HotStats data, which enables us to track and analyse changes in the three key areas of hotel operating costs - labour, food and beverage (F&B), and utilities. And while there are finally signs of inflationary pressure starting to stabilise and ease for energy and food costs, profitability will take a hit from the increase in payroll costs.

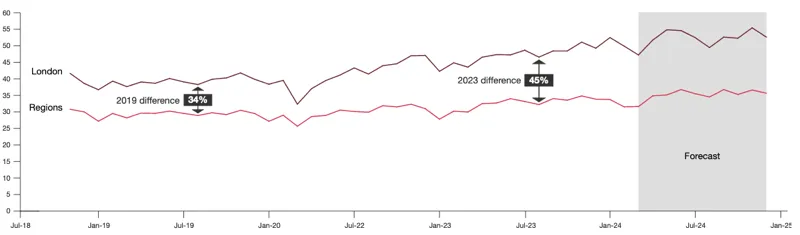

UK hotels GOP margin trend since pre-COVID (as % of revenue)

Source: HotStats, STR, PwC analysis (figures for COVID-affected anomaly years 2020-2021 removed)

Labour cost headwinds blowing in

The NLW will increase by 9.8% from April 2024 for those aged 21 and over due to the removal of the 21-22 age grouping. This extension of the NLW to those aged 21 and over (from 23 and over previously) is likely to lead to higher staff cost increases for the hospitality sector, which typically attracts a young workforce.

Labour cost per available room (£)

Source: HotStats, STR, PwC analysis (figures for COVID-affected anomaly years 2020-2021 removed)

New legislation around holiday entitlement and holiday pay calculations for part time and casual staff will also come into effect in April 2024 – which is expected to have a further upward effect on total labour cost – and the impact of this should be assessed by all hospitality sector operators as part of a comprehensive staff cost analysis.

In addition, the earning threshold for skilled worker visas will increase to £38,700 from April, potentially shrinking the available talent pool and increasing both competition for labour as well as labour cost. This will exacerbate the fact that vacancies in hospitality are already higher than pre-pandemic. At a time when the majority of UK CEOs (78%) across all industries report some extent of skills shortage within their organisation, this both adds to labour cost pressures and negatively impacts service quality.

The impact of rising payroll cost as a percentage of revenue will be felt more severely by regional hotels because they have limited ability to increase room rates to offset this cost due to greater competition for occupancy. Relative revenue per available room (RevPAR) stability compared to 2023 will help London hotels maintain their GOP margin in 2024 - albeit still at ~2.0 percentage points below pre-COVID levels in 2019.

There may also be an element of labour cost catch-up for the regions, based on the widening gap between London and regions from 2019 to 2023 related to Labour cost per available room from 34% to 45% (see chart above). London has already experienced a +28% change in labour costs since 2019, versus only +19% in the regions. In comparison, the NLW has increased by 33% between 2019 and 2023.

Food and Beverage (F&B) margins stabilise

Limited further year-on-year menu price increases should be required to maintain margins in light of reducing food cost inflation.

We expect London hotels to maintain F&B margins in 2024. This is a continuation of the stability we have seen between 2019-2023, with F&B cost of sale (COS) staying consistent at around 22-23% of F&B revenue.

For regional hotels, where F&B COS as a percentage of F&B revenue has increased from 24% to 27% between 2019-2023, we see that levelling off at around 27% in 2024 as food cost inflation subsides and menu pricing is maintained.

However, as F&B COS margins do not include labour costs, rising payroll costs will also have a material impact on the net profitability of hotel restaurants and bars, making it challenging for those hotels that rely more heavily on F&B sales as a proportion of total hotel income.

Utilities costs show signs of easing

Utilities costs are expected to start easing, returning close to pre-energy crisis levels during 2024. However, we do not expect energy costs to have fully reduced to pre-crisis levels by the end of the year. As a result, utilities costs per available room will only fall gradually in 2024 with no significant step change expected.

In both London and the regions we expect the falling gas and electricity costs to reduce total utilities costs per available room from ~£9 to ~£8, which is still 60%-70% higher than 2019.

This is consistent with the wider Hospitality and Leisure sector, which has an above average energy spend according to our UK Energy Survey 2024. Over the next two years, 36% of businesses claim that high energy costs will significantly squeeze margins and reduce their UK competitiveness. Yet most businesses report a lack of visibility in their energy usage (68%) and energy spend (62%) as barriers to mitigating these costs.

2024 UK hotels performance update and outlook

In the final quarter of 2023, occupancy for London hotels outperformed our annual UK Hotels Forecast. Demand continues to remain strong in London and in line with our 73% Q1 forecast based on the first two months of trading at the start of 2024. However, occupancy growth in the UK regions has remained flat year-on-year at 67% for the two months of 2024, as forecast, driven by weaker domestic demand.

Actual ADR growth across the UK has been limited for the first two months of the year and is forecast to slow overall for Q1 2024, particularly in London. ADR in London is forecast to hit £167.7 for Q1, below our original forecast of £178.5, while in the regions we expect ADR for Q1 to end up below our forecast of £87.2. This is due to inflation falling more rapidly than previously forecast, the UK going into technical recession at the end of 2023, and shifting demand from higher paying leisure customers to lower paying corporate customers.

However, our Retail Outlook 2024 offers some optimism for the UK hotels sector, with consumers saying they are prioritising their spending on experiences, and in particular holidays.

“Despite the bigger picture of falling inflation, the rises in the NLW and the continued competition for labour mean payroll will be the biggest operational cost challenge for UK hotel operators in 2024,” says Rick Jones, Hospitality, Sport & Leisure Leader, PwC UK. “With downward pressure on room rates also hitting revenue growth, maintaining or improving profitability in this tough environment will require an even stronger focus on cost control through thorough analysis, forecasting and mitigation planning.”