Sentiment climbs for the second survey in a row, but consumers remain cautious

Consumer sentiment begins to climb as the cost-of-living crisis possibly shows light at the end of the tunnel, even with a slight rise in inflation in February. Though inflation continues to affect nearly everyone, some consumers are starting to feel slightly better financial stability as cutbacks reduce for many. But there’s also polarising confidence across demographic and socioeconomic groups, with the youngest, oldest and most affluent groups feeling those improvements more than most. And as we head into spring and summer, consumers may look to prioritise holidays, home and health at the expense of other discretionary spending categories. What does all of this mean for consumer businesses?

Sentiment climbs for the second survey in a row, but consumers remain cautious

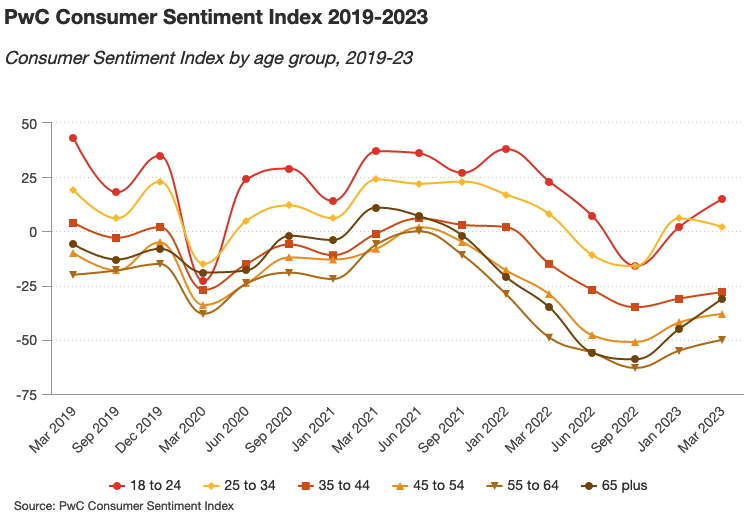

Consumer sentiment has recovered well since Autumn last year, even amid global economic uncertainty and continued inflationary pressures.

In October, we revealed the true impact of a series of global crises on consumer confidence. From food and fuel shortages in Autumn 2021, to rising inflation and the war in Ukraine in the following Spring, and onto a cost-of-living crisis last summer, consumer sentiment had dropped to an almost historic low of -44. Only once had it been lower once, at the start of the Global Financial Crisis (-51).

Since then, things have begun to look more positive. In January, our Retail Outlook showed consumer sentiment beginning to trend in the right direction, improving slightly to -32. This time, with our survey taken just after the Budget, sentiment has climbed again, to -25.

While it remains negative, it is still a whisker better than the first COVID-19 lockdown (-26), and significantly above the peak of the austerity period in 2012 (-42). It’s also the first successive period of improved sentiment since 2021.

Despite wider economic challenges and worries continuing, consumers are looking to cut back less, with certain sections of the public doing better than others. In positive news, most consumers are making ends meet, with only one in ten telling us they are either struggling, down from 13% in Autumn last year.

Though inflation is still the biggest factor affecting spending intentions, impacting 4 in 5 of us, as it tapers away throughout the year, there’s optimism that things will start to feel better for many.

Polarising fortunes across demographics

In a continuing trend from the beginning of the year, there is a significant polarisation between age and socio-economic groups, with sentiment improving fastest among under 25s and over 65s, while 25-34 year olds and the poorest socio-economic group have seen a decline.

The sentiment of under 25s has increased by 13 points (to +15), retaking their place as the most positive age group from 25-34 year olds. The sentiment of over 65s has increased the most since our last survey, by 14 points (to -31), seemingly more sheltered from the cost-of-living crisis than others. These results are largely driven by more younger people living at home (and therefore having more disposable income and a desire to spend!), and older people having savings, lower (or no) mortgage repayments and the pensions triple lock. Elsewhere, although 25-34 year olds have seen a decline from our previous survey, they remain net positive (+2).

From a socio-economic perspective, the most affluent are unsurprisingly the most positive, up 12 points to -8. The least affluent are the only category to see a decline, dropping 5 points (to -53) to remain the most pessimistic about their finances.

The youngest and oldest age groups are now likely to be the most protected, with 25% of over 65s and 20% of under 25s expecting to keep up their standard of living, compared to just one in ten 55 to 64 year olds. And that polarisation is evident not just in how much they’ll spend, but what they’ll spend on and where they’ll spend it.

More money, fewer cutbacks - are finances stabilising?

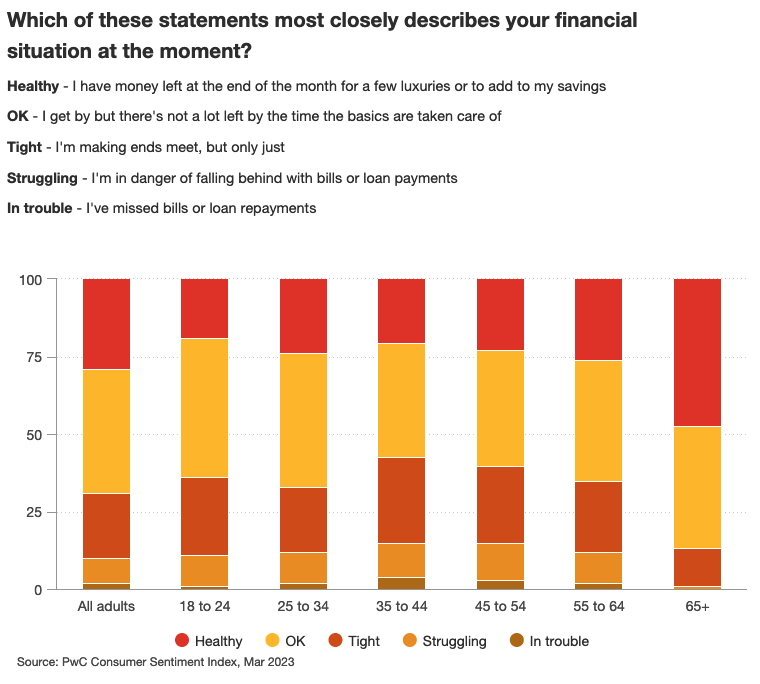

Encouragingly, financial situations look to be stabilising across most ages and demographics. Household financial situations have remained similar to results in January, but are a slight improvement on Autumn last year. Now, only 1 in 10 say they are ‘in trouble’ or might miss bills, 69% do not consider themselves to be struggling, and nearly a third now believe their finances are ‘healthy’.

Retirees and the more affluent continue to have the most healthy finances, while the less affluent and 35-54 year olds remain under the greatest pressure. The biggest improvement in finances is among the over 65s, which goes a long way to explain their uptick in sentiment: 47% of that demographic now consider themselves ‘healthy’, leaving them with money left over for luxuries or savings every month.

That increasing financial positivity is reflected in fewer consumers expecting to cut back in the next three months. Compared with last Autumn, there has been a reduction across almost every category, suggesting people are not having to worry quite as much. Nearly one in four tell us they’re now not looking to cut back spending at all.

Two categories with significant declines from recent surveys are energy bills and petrol prices. These have long been a financial pinch for all consumers, so to see them become less of a worry is particularly encouraging. And as we head into spring and summer, a need to cut back on energy prices may decrease even further.

Again, we can see the polarisation of sentiment in action, with the oldest and youngest groups looking to cut back significantly less than others, with one in three over 65s telling us they do not intend to cut back at all anymore. This trend is mirrored by the most affluent socio-economic groups, who similarly will look to cut back spending less (1 in 4).

Inflation impact still significant

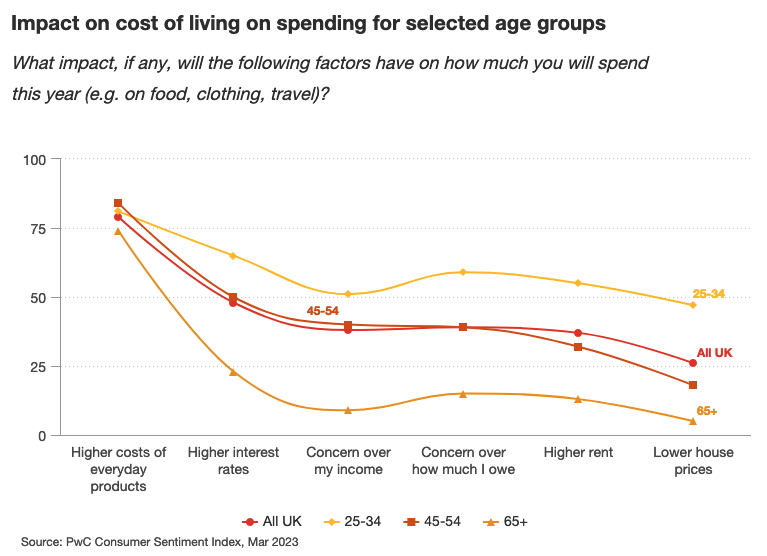

Inflation is the biggest factor affecting consumer spending intentions. Across all age groups, 4 in 5 consumers tell us that the higher cost of everyday products is a key factor in their spending.

Those inflationary pressures are also starting to diverge. Food price inflation continues to climb, at least in the short term, impacting not only grocery, but restaurant and cafe prices. Conversely, transport price inflation continues its downward trajectory as petrol and diesel prices fall back further.

Interestingly, while the impact of inflation is universal across all age groups, interest rates, house prices and rent rises only affect a minority of people’s spending intentions. In almost a reverse of the sentiment polarisation we’re seeing, these concerns affect the younger and more affluent significantly more than other demographics. While most 25-34s are affected by higher interest rates and rents, they don’t impact the majority of over 45 year olds. This is largely because the young are more likely to be renting, or have larger mortgages that are more vulnerable to interest rate hikes, whereas many over 45s either have small mortgages or own outright. Over 65s, especially, appear largely unaffected by everything other than inflation.

While inflation had a surprise increase in February in part due to fresh food prices, we’re already seeing transport and energy price inflation slowing. Later this year, food price inflation is likely to slow, too, as we pass the anniversary of the biggest price rises in 2022, meaning there’s a good prospect of lower inflation across the board in the second half of 2023. All that suggests that pay and national living wage increases will outstrip inflation by the year end, and disposable incomes will start to rise in real terms.

How does this affect spending intentions?

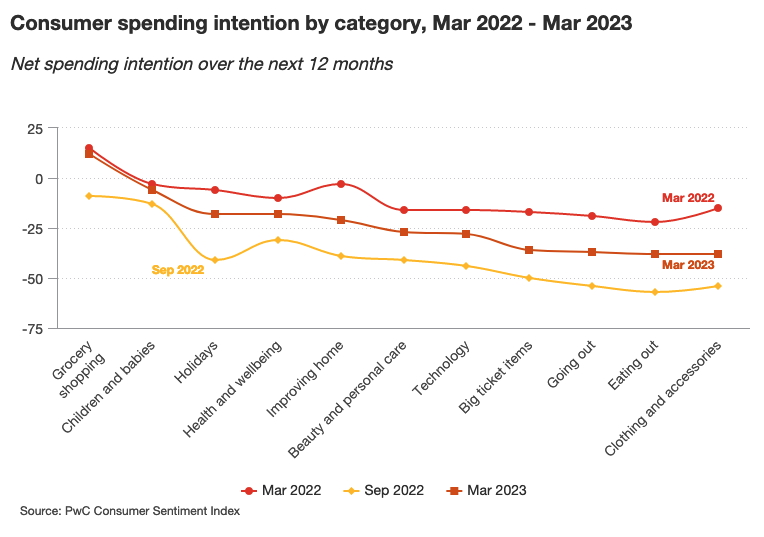

Perhaps unsurprisingly given the current environment, spending intention continues to be negative across every category except grocery - i.e. more consumers expect to spend less on these categories in the next 12 months than spend more. Other non-discretionary categories are also more protected, with consumers generally prioritising spending on pets and children.

However, despite remaining in negative territory, there is an air of normality returning as category spending intentions stabilise, having improved significantly since the Autumn and now showing a broadly similar pattern to this time last year.

After falling into negative territory for the first time last Autumn, grocery has now returned to a net positive spending intention, with more of us expecting to spend more in the supermarket over the next 12 months than spend less. While likely driven up by double-digit food price inflation, it may still suggest that people are a little more financially stable, and no longer looking to buy less or trade down as often.

Holidays, health and home lead the non-discretionary categories, as consumers look to protect certain categories that remain important to them. Continuing a trend from our January survey, higher income groups are planning to spend more, with over 65s in particular prioritising spending in these categories the next year.

Eating out, going out and fashion currently remain at the bottom of the list for consumers as they prioritise where they are spending. Though as we start to move into better weather, there is a chance that these will begin to pick up, particularly for the younger age groups. It’s also worth bearing in mind that these categories traditionally tend to come out more negative in our survey findings than in reality, so it’ll be interesting to see the performance over the coming months.

There is an interesting split by age. The spending intentions of younger consumers are now the most resilient, particularly on fashion and going out, which shows a slight recovery across that age range as under 25s look to protect going out and fashion. Over 65s, who were the least likely to cut back spending in Autumn last year, are still resilient, with 45-54s being the most negative across all categories, and most likely to cut back in general.

What does this mean for consumer businesses?

While still challenging times for businesses and consumers, we’re seeing the sector slowly return to normal. Stabilising consumer sentiment should be viewed as positive, even if it remains in negative territory. We should expect to see more positive intentions later in the year as inflation falls away.

There are a few actions retailers can take to best prepare for better times.

Capitalise on consumer trends

From the pandemic to the war in Ukraine, external events have changed or accelerated consumer trends and demand over the last few years. Not just COVID and Ukraine, but things like the wellness agenda, alternative food and beverage, health and beauty etc.

As consumer finances begin to stabilise, certain groups have money left at the end of the month to either save or spend. Those retailers that can find these groups - and the right demographic - may be able to encourage them to spend responsibly. As with previous advice in Autumn 2022, the challenge will be balancing those that can spend with those who may need help to mitigate their financial challenges.

That may be offering alternatives for those cutting back while being able to provide options for those that have a little space for discretionary spending.

Rethink models and channels to navigate inflation and embed resilience

To manage future shocks, whatever they may be, retailers may look to take certain actions. For many, they may look to pivot around customer propositions and operating models, as well as manage cash flow.

Some may look to rethink hybrid business models in a way that allows them to acquire new customers and manage existing ones, through options such as marketplaces, social commerce, and resell platforms. Others may look to rebalance marketing and sales channels to engage with more consumers, particularly in the face of changes to privacy regulations, tech algorithms and the rising cost of customer acquisitions.

To resolve all of these challenges, retailers should look to invest through the cycle where they can, to reinvent their business models in a way that delivers sustained long-term success.

Seek out ways to find value and investment

While there are unquestionably green shoots, we're not completely through the storm yet. Consumers are still trading down, cutting back, and changing how and where they shop. Costs are still rising for retail and consumer businesses, even if not as much as before. There will be distress for some. But where there is distress, there will be opportunities to acquire good brands.

Businesses must be prepared for this, looking for ways to protect and deliver value, showing innovation to identify new opportunities, and using technology to realise deal and investment success. That could be finding growth through acquisition, or it could be unearthing ways to share fixed costs or consolidate. With our Global M&A Trends in Consumer Markets: 2023 Outlook suggesting that retail and consumer markets investment activity will continue to be strong, particularly across grocery, consumer goods and consumer health, there will remain opportunities for those willing to be bold and think strategically.

Notes

- PwC’s latest Consumer Sentiment Survey was conducted between 17-20 March 2023 and includes responses from a nationally representative sample of 2,060 adults.

- PwC has asked the same question every few months since April 2008: “Thinking about your disposable income (money remaining after household bills, credit cards, etc.), in the next 12 months do you expect that your household will be better off or worse off?”. The index is calculated by subtracting the percentage of people who think they will be worse off from those who think they will be better off. Historically this index has provided an insight into the pulse of the nation, and has been a good indicator of future consumer spending patterns.